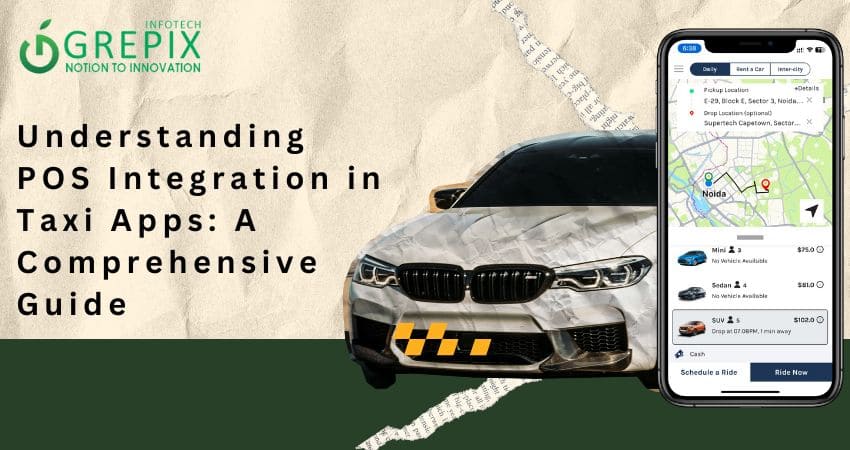

Understanding POS Integration in Taxi Apps: A Comprehensive Guide

The taxi industry has witnessed a significant transformation over the past decade, thanks to the rise of mobile applications and digital payment solutions. Gone are the days when customers had to fumble for cash or wait for change; today, they expect seamless, quick, and secure payment options. This is where Point of Sale (POS) integration in taxi apps comes into play.

POS integration in taxi apps not only improves customer experience but also benefits taxi businesses by streamlining transactions, reducing errors, and increasing efficiency. Whether you’re a taxi operator looking to enhance your services or a developer aiming to build a robust taxi booking platform, understanding the role of POS systems in taxi apps is crucial. This guide will provide an in-depth look at how POS integration works, its benefits, challenges, and best practices.

The taxi industry has evolved significantly with the rise of mobile applications and digital payment solutions. POS integration in taxi apps has transformed the payment process, providing customers with seamless, quick, and secure transaction options. It benefits taxi businesses by automating fare calculations, reducing errors, and improving operational efficiency. Supporting multiple payment methods like credit/debit cards, mobile wallets, and QR code payments, POS integration enhances the user experience and financial transparency. While challenges like integration complexity and security concerns exist, following best practices ensures smooth implementation. As digital payments continue to advance, POS systems will remain crucial in modernizing taxi services.

What is POS Integration in Taxi Apps?

POS integration in taxi apps refers to incorporating point-of-sale systems into ride-hailing platforms, enabling seamless and automated payment processing. A POS system allows passengers to pay for their rides using various methods, including:

- Credit and Debit Cards: Direct card payments using chip readers or contactless technology.

- Mobile Wallets: Digital payment methods like Apple Pay, Google Pay, and PayPal.

- QR Code Payments: Scanning a QR code to complete a transaction.

- Cash Payments: While digital transactions dominate, some POS systems still allow drivers to record cash payments for better tracking.

By integrating POS into taxi apps, companies can automate fare calculation, process payments instantly, and provide receipts electronically. This enhances both customer satisfaction and operational efficiency.

How Does POS Integration Work in Taxi Apps?

Integrating a POS system into a taxi app involves multiple components working together to facilitate smooth transactions. Here’s a step-by-step breakdown of how it functions:

1 Ride Booking and Fare Estimation

When a passenger books a ride, the taxi app calculates the estimated fare based on distance, time, and surge pricing. The estimated fare is then displayed to the passenger before confirming the ride.

2 Ride Completion and Fare Calculation

Once the ride ends, the system calculates the final fare, including additional charges such as waiting time, toll fees, or discounts.

3 Payment Processing

At the end of the ride, the POS system is triggered, offering multiple payment options. The passenger can choose their preferred method of payment card, mobile wallet, or cash. If using a card, the POS system processes the transaction securely.

4 Receipt Generation and Transaction Logging

Once the payment is successful, an electronic receipt is generated and sent to the passenger via email or app notifications. Meanwhile, the transaction is logged in the system for records, making it easier for drivers and taxi companies to track earnings.

By following this seamless process, POS integration enhances transparency and reduces friction in taxi transactions.

Benefits of POS Integration in Taxi Apps

1 Enhanced Customer Experience

POS integration in taxi apps significantly enhances the customer experience by offering multiple payment options, ensuring convenience for all passengers. With digital payments, there’s no need to carry cash, making transactions faster, safer, and more efficient. Additionally, instant digital receipts help passengers track their expenses with ease, adding to the overall transparency and reliability of the service.

2 Increased Efficiency for Taxi Operators

For taxi operators, POS systems automate fare calculations and payment processing, reducing the chances of human errors. With digital records, drivers and businesses can easily track earnings and financial transactions without manual bookkeeping. Moreover, automated payments help minimize disputes related to incorrect fares or fraudulent transactions, improving operational efficiency.

3 Improved Security

By integrating secure payment gateways, taxi apps can protect passenger data and reduce the risk of fraud or cyber threats. Since digital transactions limit the reliance on cash, drivers are less likely to become targets for theft or robbery, ensuring a safer working environment. This added layer of security benefits both passengers and service providers.

4 Better Financial Management

A well-integrated POS system streamlines financial management by maintaining accurate digital records of transactions. This not only helps in tracking revenue seamlessly but also simplifies tax calculations and ensures compliance with financial regulations. With clear financial data, taxi businesses can make informed decisions and improve their profitability.

Challenges of POS Integration in Taxi Apps

1 Technical Integration Complexity

Integrating POS systems into taxi apps can be complex, as different providers have unique APIs and requirements. Ensuring seamless compatibility across multiple devices and platforms adds another challenge, requiring careful planning and technical expertise.

2 High Transaction Fees

Payment processing companies charge transaction fees that can impact the profit margins of taxi businesses. To minimize costs, it's essential to choose a POS provider with competitive rates while maintaining reliable and secure payment processing.

3 Security and Compliance Issues

Handling customer payment data demands strict adherence to security regulations like PCI DSS to prevent data breaches. Taxi companies must invest in robust fraud prevention measures to ensure safe transactions and build customer trust.

4 Driver Training and Adoption

Drivers need proper training to efficiently use POS systems and handle digital transactions. However, some may resist the transition due to a preference for cash payments, making it essential to provide clear guidance and incentives for adoption.

Overcoming these challenges requires proper planning, selecting the right POS provider, and ensuring compliance with industry regulations.

Best Practices for Successful POS Integration in Taxi Apps

To ensure a smooth and efficient POS integration process, taxi service providers should follow these best practices:

1 Choose a Reliable POS Provider

Select a POS provider with a strong reputation, high-security standards, and affordable transaction fees. Some popular options include Square, Stripe, and PayPal.

2 Ensure Compatibility with Multiple Payment Methods

The more payment options available, the better the customer experience. Ensure the POS system supports credit cards, debit cards, mobile wallets, QR codes, and even cryptocurrency payments if needed.

3 Implement Robust Security Measures

Protect customer payment data with end-to-end encryption, tokenization, and two-factor authentication. Compliance with PCI DSS (Payment Card Industry Data Security Standard) is essential.

4 Provide Seamless User Experience

Ensuring a smooth payment process is crucial for customer satisfaction. Taxi apps should offer a quick, intuitive, and user-friendly payment experience, minimizing delays. Features like one-tap payments can significantly reduce friction, allowing passengers to pay instantly without extra steps. Additionally, sending automatic digital receipts enhances transparency, helping users track their expenses effortlessly.

Also Read: "Enhancing Customer Experience: The Power of a RedBus Clone for Bus Ticket Booking"

5 Regularly Monitor and Update the System

To maintain security and efficiency, taxi apps must conduct regular security audits to identify and fix vulnerabilities. Cyber threats and payment fraud are constantly evolving, making it essential to update the software frequently to comply with the latest security protocols. Keeping the system up-to-date ensures seamless transactions, improved reliability, and enhanced user trust in the app.

By following these practices, businesses can ensure a smooth and secure POS integration process, leading to higher customer satisfaction and operational efficiency.

Future Trends in POS Integration for Taxi Apps

The world of digital payments and taxi services is evolving rapidly. Here are some future trends to watch:

1 Contactless and Biometric Payments

Taxis will probably start using biometric authentication techniques in the future for safe transactions as contactless payments and facial recognition technology gain traction.

2 AI-Powered Fraud Prevention

Artificial intelligence will play a key role in detecting and preventing fraudulent transactions, improving security for both passengers and drivers.

3 Cryptocurrency and Blockchain Payments

Some taxi apps are already exploring cryptocurrency payments for decentralized and secure transactions. Blockchain technology could enhance transparency and reduce fraud risks.

4 Subscription-Based Payment Models

Taxi companies may introduce subscription plans for regular riders, allowing them to pay monthly for unlimited or discounted rides. As these trends continue to shape the industry, staying ahead of technology will be crucial for taxi businesses looking to remain competitive.

As these trends continue to shape the industry, staying ahead of technology will be crucial for taxi businesses looking to remain competitive.

Conclusion

The taxi industry has undergone a remarkable transformation, with POS integration emerging as a vital component in modern ride-hailing apps. By enabling seamless, secure, and cashless transactions, POS systems enhance customer experience, improve financial transparency, and streamline operations for taxi businesses. While challenges like technical integration, transaction fees, and security compliance exist, adopting best practices and staying ahead of emerging trends such as AI-driven fraud prevention, contactless payments, and blockchain technology will pave the way for a smarter, more efficient taxi ecosystem.

At Grepix Infotech, we specialize in cutting-edge taxi app development, ensuring your platform is equipped with robust POS integration for seamless transactions and an enhanced user experience. As a trusted industry leader, we empower businesses with scalable, secure, and feature-rich ride-hailing solutions tailored to meet evolving market demands.

Partner with Grepix Infotech today to build a next-gen taxi app that drives growth, efficiency, and customer satisfaction!

FAQs

1. Why is POS integration important in taxi apps?

POS integration ensures seamless, secure, and cashless transactions, improving customer convenience and business efficiency.

2. What are the most common payment methods supported by taxi POS systems?

Taxi POS systems typically support credit/debit cards, mobile wallets (Apple Pay, Google Pay), QR code payments, and cash transactions.

3. How does POS integration improve security in taxi apps?

By using encryption, tokenization, and fraud prevention measures, POS systems protect customer payment data from breaches.

4. What challenges do taxi companies face with POS integration?

Taxi companies face challenges with POS integration, including hardware compatibility, payment processing issues, connectivity problems, security concerns, regulatory compliance, driver training, integration with ride-hailing apps, and ongoing maintenance. Ensuring seamless transactions while meeting industry standards can be complex.

5. Can taxi apps integrate multiple POS providers?

Yes, many taxi apps integrate multiple POS providers to offer flexibility and a wider range of payment options for passengers.

Looking out to start your own venture like Uber? Try out our HireMe Taxi Uber Clone, the easiest way to kick-start your taxi business.